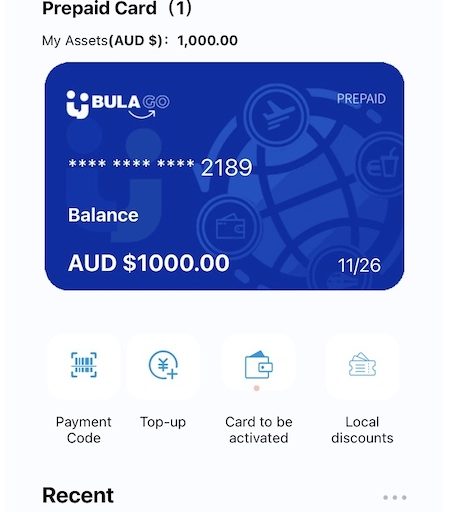

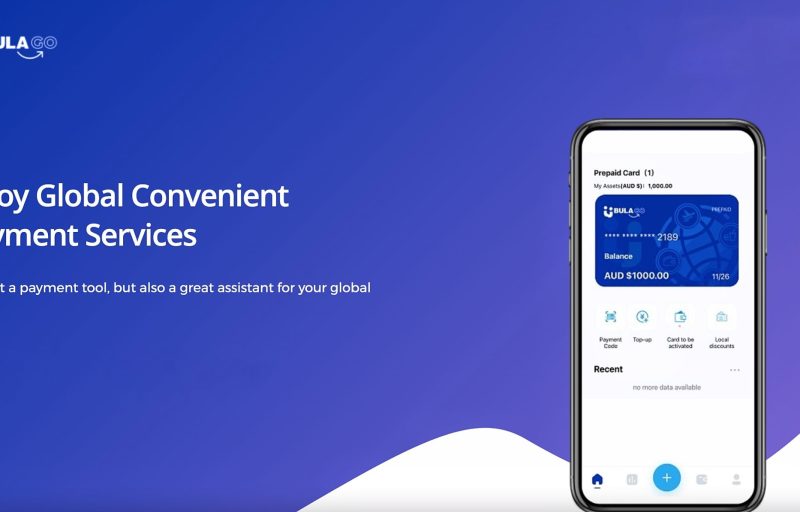

Virtual Card Management Services

A content management system helps you create, manage, and publish content on the web. It also keep content organized and accessible so it can be used and repurposed effectively.

In today’s fast-paced digital economy, the demand for secure, efficient, and versatile payment methods has skyrocketed. Virtual cards have emerged as a leading solution, providing consumers and businesses with a convenient and secure way to manage transactions. A virtual card is essentially a digital version of a physical card that can be used for online purchases, subscriptions, and other digital payments. These cards are typically tied to a primary account, such as a bank account or a digital wallet, and can be issued instantly, allowing for immediate use.

Advantages of Virtual Cards in the Gift Card Market

Instant Delivery: One of the key advantages of virtual cards in the gift card market is their ability to be delivered instantly. Traditional gift cards require physical shipping, which can take days, while virtual gift cards can be sent via email or text message within seconds, making them perfect for last-minute gifts.

Personalization: Virtual gift cards can be easily personalized with messages, designs, and even video greetings, offering a more customized gifting experience. This level of personalization is difficult to achieve with physical cards.

Cost-Effective: Since virtual cards do not require physical production, packaging, or shipping, they are significantly more cost-effective. This not only reduces costs for businesses but also allows for competitive pricing in the gift card market.

Enhanced Security: Virtual cards offer better security features compared to physical cards. They are less prone to loss or theft and often include features like spending limits, expiration dates, and usage tracking, adding additional layers of security.

Environmental Impact: By eliminating the need for physical materials, virtual cards contribute to reducing the environmental impact associated with the production and disposal of plastic cards.

Successful Case Studies in Virtual Card Management

Corporate Expense Management: A global technology company implemented a virtual card system for managing employee expenses. By issuing virtual cards for travel and office supplies, the company was able to set spending limits, track expenses in real-time, and reduce the risks associated with physical card misuse. The integration of virtual cards also streamlined the reconciliation process, resulting in significant time and cost savings.

Online Retail: An e-commerce giant adopted virtual gift cards as a key component of its loyalty and rewards program. Customers could purchase virtual gift cards and send them instantly to friends and family, driving up gift card sales during the holiday season. The virtual cards were also integrated with the company’s mobile app, allowing customers to easily redeem them at checkout, which enhanced the overall shopping experience.

Subscription Services: A leading streaming service used virtual cards to manage promotional offers and free trials. Instead of issuing physical cards, the company provided virtual cards with preset expiration dates, which automatically deactivated after the trial period. This approach reduced operational costs and minimized the risk of unauthorized usage while also simplifying the management of promotional campaigns.

Education Sector: A university implemented virtual cards to manage student stipends and scholarships. By providing students with virtual cards, the university could control spending categories, such as textbooks and supplies, while ensuring that funds were used appropriately. This initiative not only improved financial oversight but also enhanced the student experience by providing a convenient and flexible payment option.

Virtual cards are transforming the way businesses and consumers handle transactions, offering unparalleled convenience, security, and flexibility. With their growing application across various industries—from corporate expense management to online retail—virtual cards are poised to become an integral part of the digital economy. Companies that adopt virtual card management services, like those offered by Airpay, will be well-positioned to capitalize on these advantages and meet the evolving demands of their customers.